Disney DIS to Forgo Next Semi-Annual Cash Dividend Disney DIS to forgo semiannual dividend for the first half of the year preserving 16 billion in cash See More. DISs 7th split took place on July 10 1998.

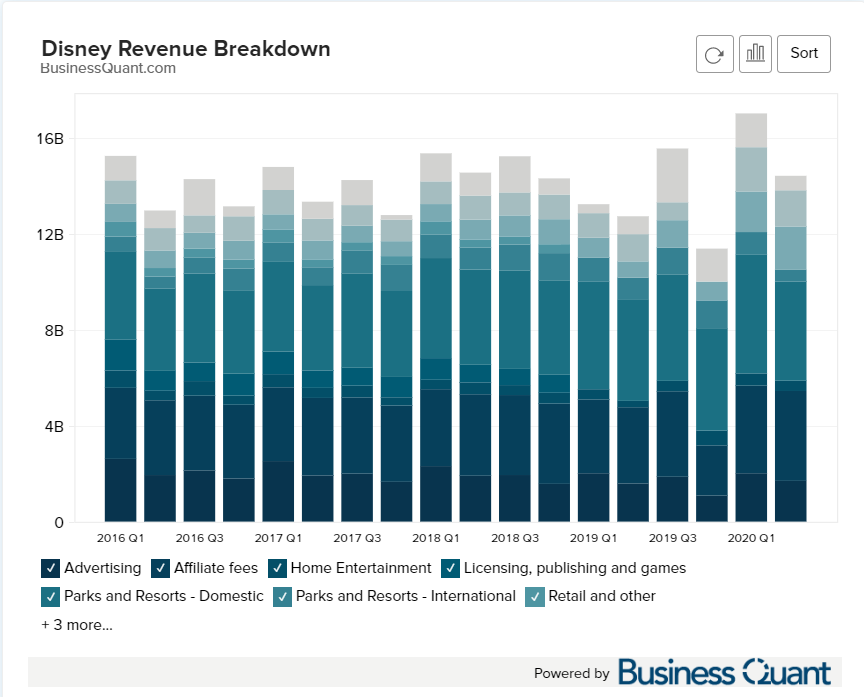

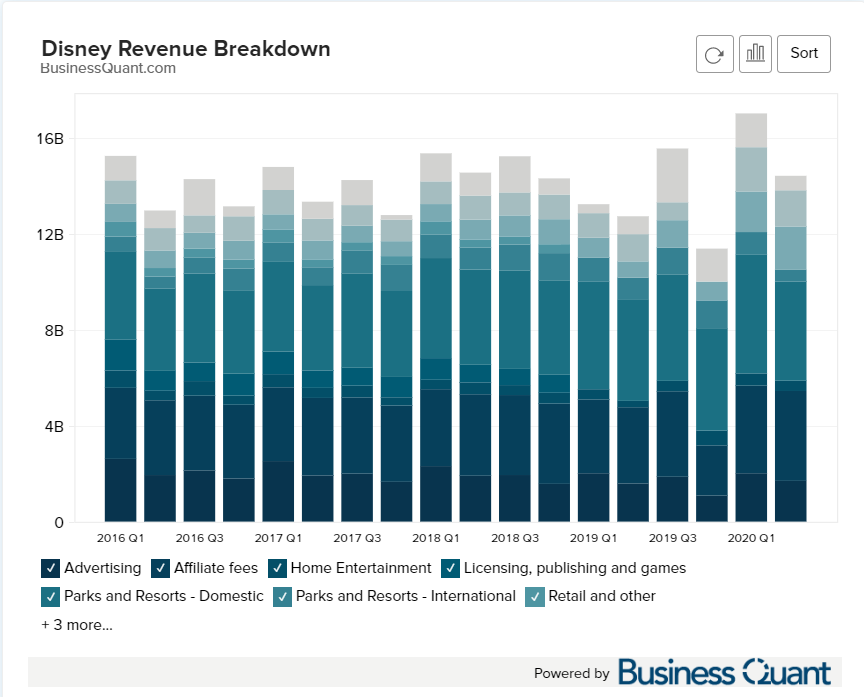

Disney Revenue Breakdown Worldwide 2016 2021

Ad Do Your Investments Align with Your Goals.

How often does disney stock split. This was a 103 for 100 split meaning for each 100 shares. Since its IPO the company split its shares another six times. The average pre-split closing price is 15063 but this doesnt mean that investors have to wait for the stock to soar 55 from here for its next stock split.

Walt Disney Company The Common Stock DIS Nasdaq Listed. Ad Do Your Investments Align with Your Goals. All shareholders who own the stock the trading day before the ex-date will.

A company announcing a split usually sets an effective date of 1030 days after the announcement. With a stock split the share price drops to reflect the split and becomes cheaper for. There are big rumors about the possibility that The Walt Disney Company will make a split of its shares in the near future during 2016.

The most common types of stock splits are 21 32 and 31 although there are some stock splits that can be as high as 41 71 or even higher. New Look At Your Financial Strategy. Disney said the stock split is subject to shareholder approval but is expected to be completed by JulyDisney will ask for an amendment allowing it to increase its allowed shares.

Stock split history for Disney since 1962. This was a 3 for 1 split meaning for each share of BUD owned pre-split the shareholder now owned 3 shares. Please see the Historical Prices tab for adjusted price.

A stock split is one strategy that companies deploy to increase liquidity in their stocks. Find a Dedicated Financial Advisor Now. Quickest stock price recoveries post dividend payment.

Stock split history for Ball since 1984. Find a Dedicated Financial Advisor Now. Four-for-one splits in 1986 and 1992.

When Did Disney Stock Split 1998. Walt Disney DIS has 8 splits in our Walt Disney stock split history database. For example a 1000 share.

This was a 3 for 1 split meaning for each share of DIS owned pre-split the. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and. Prices shown are actual historical values and are not adjusted for either splits or dividends.

Visit The Official Edward Jones Site. Previously always is good to review the history Disney. New Look At Your Financial Strategy.

There were two more 2 for 1. Disneys dividend yield is dependent on the dividend policy established by the companys board of directors and how the stock price changes. The Walt Disney Company.

Visit The Official Edward Jones Site. Because the intrinsic value of the stock does not. Disney did two-for-one splits in 1967 1971 and 1973.

Disney stock has been a part of six stock splits since the IPOThe first post IPO stock split happened in 1967 which was a 2 for 1 stock split. The first split for DIS took place on December 18 1962. Please see the Historical Prices tab for adjusted price.

Over the last five years. Also it shows that Walt Disney does not consider the 103 shares for 100 shares and 1014 shares for 1000 shares as stock splits. Data is currently not available.

The first split for BUD took place on June 17 1985. 535 314 DATA AS OF Nov 05 2021. Prices shown are actual historical values and are not adjusted for either splits or dividends.

The best guide would.